Tax risk management needs to be a proactive process. Lacking the appropriate tax expertise can have far-reaching implications for mid-market businesses beyond just financial repercussions. It can also affect their reputation and legal compliance.

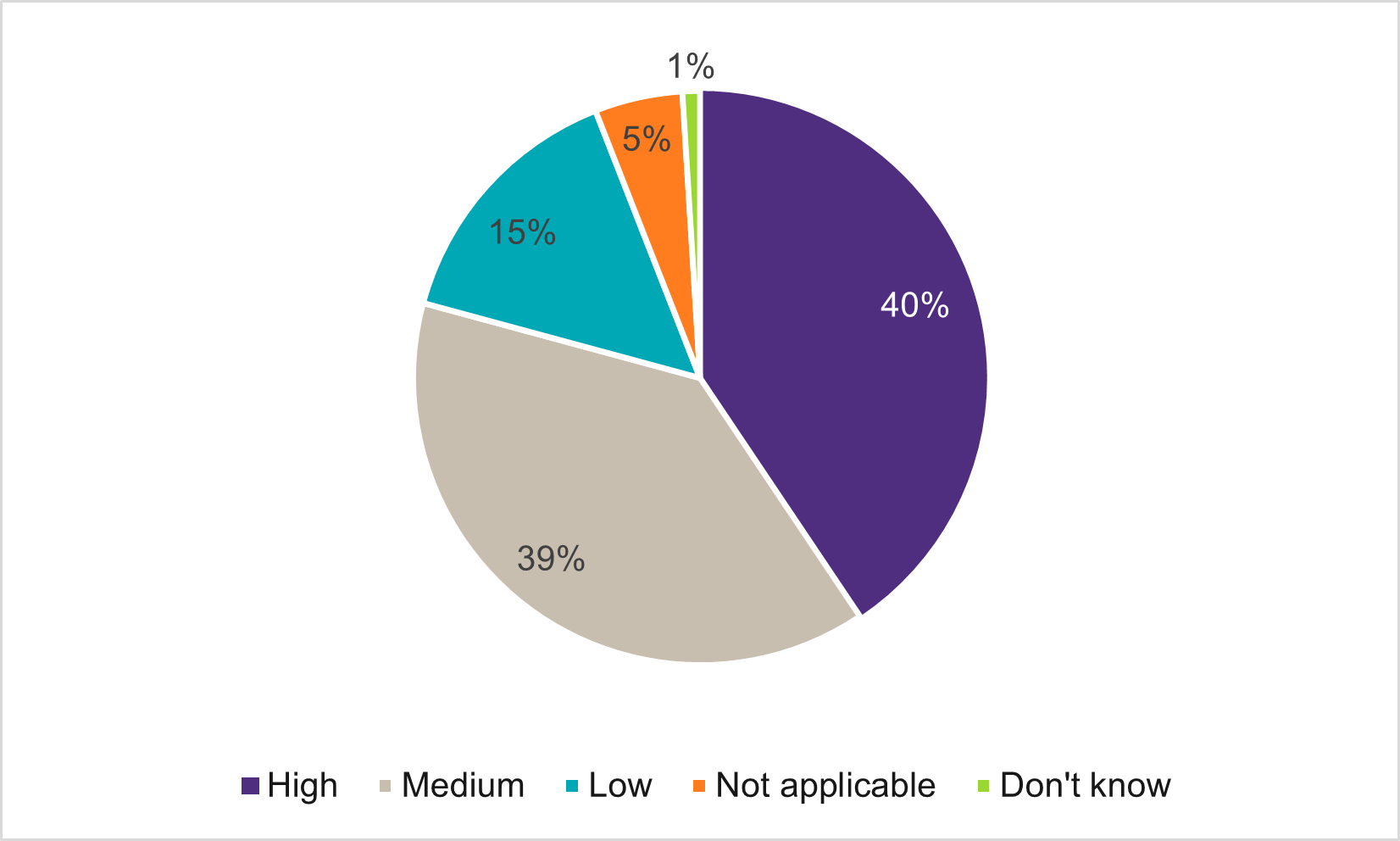

It is important for businesses to ensure that they implement tax strategies in line with their business strategies. In a business market survey for the International Business Report, conducted between August and October 2022, when questioned on the risk of not having the right skillsets, 41% of mid-market businesses agreed that the risk was high, 39% believed the risk was medium, and only 15% said the risk was low.

It is important for mid-market businesses to consider some of the risks of not having the right tax skillsets internally:

- Incorrect tax filings: A lack of tax expertise can lead to incorrect tax filings, resulting in over- or underpayment of taxes and hefty tax penalties.

- Non-compliance with tax laws: Businesses that lack the necessary tax expertise may be unaware of the tax laws and regulations that apply to them, resulting in non-compliance and legal disputes.

- Loss of credibility: Errors in tax filings can undermine a business’ credibility and erode its reputation among stakeholders such as investors, customers, and partners.

- Responding to enquiries: Inability to effectively respond to tax audits and government agency enquiries.

- Missed opportunities: Businesses without tax expertise may miss out on tax-saving opportunities, which could negatively impact their financial performance.

Outsourcing tax advisory and/or compliance services does not necessarily mitigate the inherent tax risks. In fact, when considering outsourcing, it is more important for the necessary skill sets to be present internally. Ryan Smit, Director – Business Process Solutions

If outsourcing is being considered and the internal skillset is not at the required level, the business may be exposed to further risks, such as:

- Complex, expensive, and non-compliant tax structures

- Lack of transparency regarding specific tax statuses

- Unplanned and unexpected tax consulting fees

- Lack of data ownership.

Tax management has a direct impact on any business’ cash flow which is why a proactive approach is needed. Work towards establishing an internal team and an external advisory team that can assist with some of the regular compliance deadlines, but also provide support on bigger transactions such as mergers, acquisitions, and transfer pricing.

SNG Grant Thornton Tax team has vast experience in providing tax services to businesses.