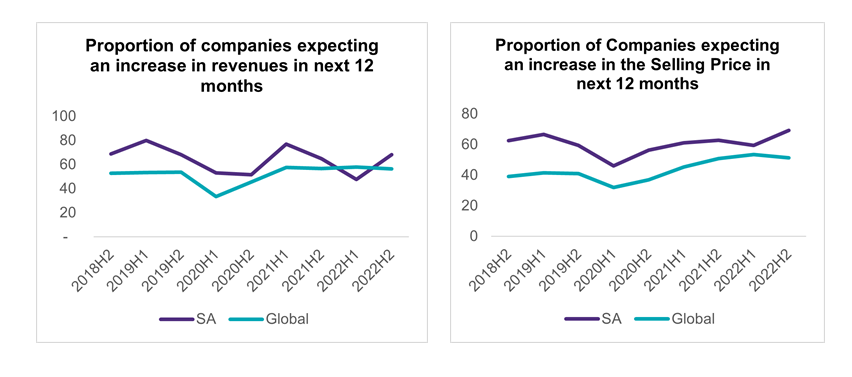

The results from the H2 2022 period suggest a rebound in expectations for revenue growth with 69% (59 % in H1 2022) of South African mid-market businesses hoping to record an increase in revenues in the next 12 months. According to the H2 2022 results, the revenue growth is mainly aligned to the expectation of an increase in the selling price, which is trending at pre-COVID-19 levels. It is important to note that the selling price to foreign markets is influenced by expectations on the exchange rate movements. In the second half of 2022 the Rand to the US Dollar exchange rate depreciated by 12.5% from 15.41% in the first half of 2022 (to 17.33% in H2 2022). At the peak time of the survey (i.e., October 2022) the exchange rate was at a low level of 18.1%.

Therefore, the optimism is due to the selling price being higher in Rand (ZAR) terms given the prevailing exchange rate movements.

The positive prospects for prices and revenues reflect that South African companies expect demand to pick up to pre-COVID levels. The revenue growth is also associated with expectations of export growth and non-domestic revenue growth. - Oupa Mbokodo, Head of Advisory.

The H2 2022 results indicate that 54% of mid-market businesses are expecting an increase in exports with a similar proportion expecting to see an improvement in non-domestic markets revenue. However, it is concerning that at a global level, there is less optimism on revenue and profitability prospects. This is largely due to the notion that at a global scale, there are glittering fears of a prospective global recession.

Inflationary pressures triggered by the Russia-Ukraine conflict resulted in central banks globally raising interest rates in a highly synchronised manner and this is weighing negatively on investment. As a result, the World Bank has forecasted a significant slowdown in global economic growth setting it at 1.7 percent in its January 2023 forecast (compared to a previous forecast of 3.0 percent). Any higher-than-expected increases in inflation and associated response by Central Banks on interest rates as well as worsening geopolitical tensions could worsen things and push the global economy into a recession.

Slow global growth and a prospective recession would potentially slow down external demand thereby weighing negatively on export revenue growth.