Loadshedding is disruptive for businesses resulting in excessive downtime. It calls for alternatives such as back-up generators, uninterrupted power supply (UPS) and solar power solution. While companies have tried alternative means, it has all come at an extra cost – especially generators, which use diesel, a commodity that has gotten significantly expensive due to rising international oil prices pushed by geo-political concerns (particularly the Russia-Ukraine conflict). As a result, loadshedding causes businesses to shut down operations thereby affecting sales and causing supply chain disruptions.

The government suggested the implementation of 5-Point plan for addressing the energy crisis, which was outlined by the Mineral Resources & Energy Minister, Gwede Mantashe. The 5-Point Plan consists of maintaining and servicing Eskom power plants, acquiring more electricity from outside of our borders, revitalising the emergency energy procurement process, and enhancing Eskom's skill capacity.

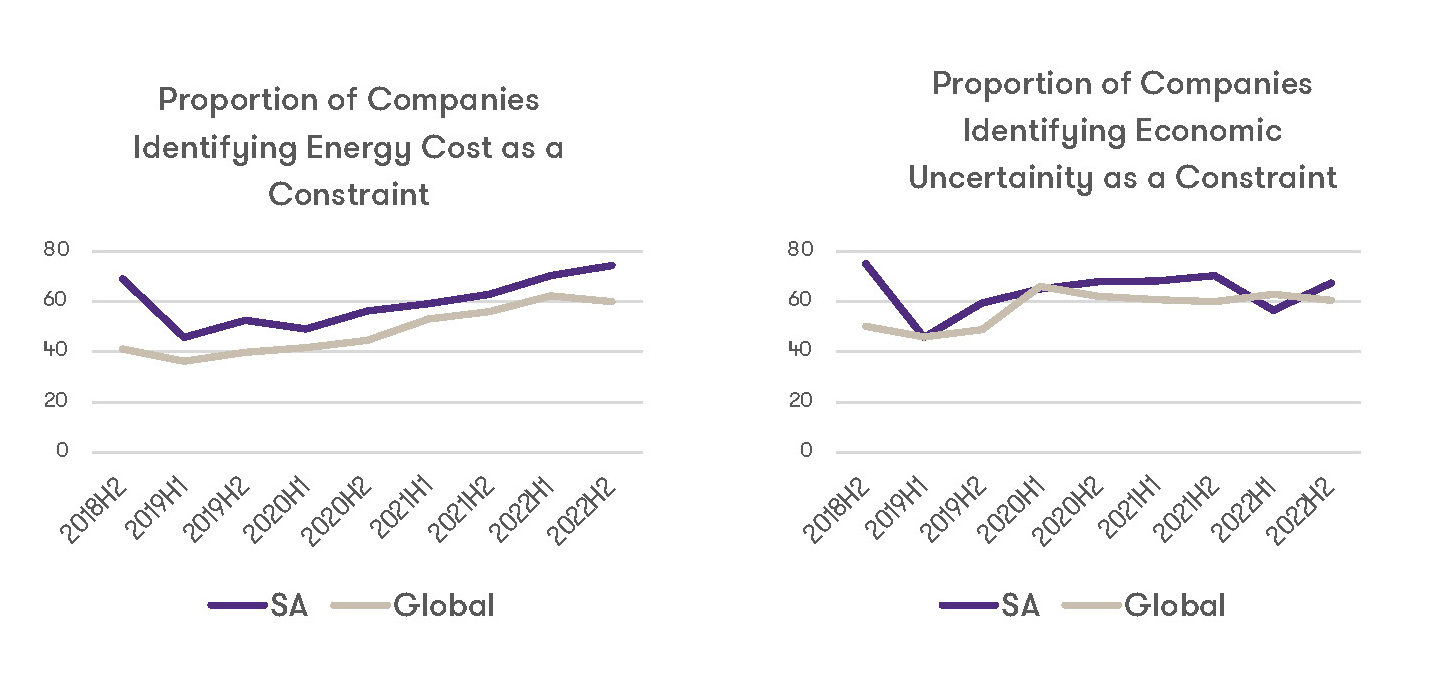

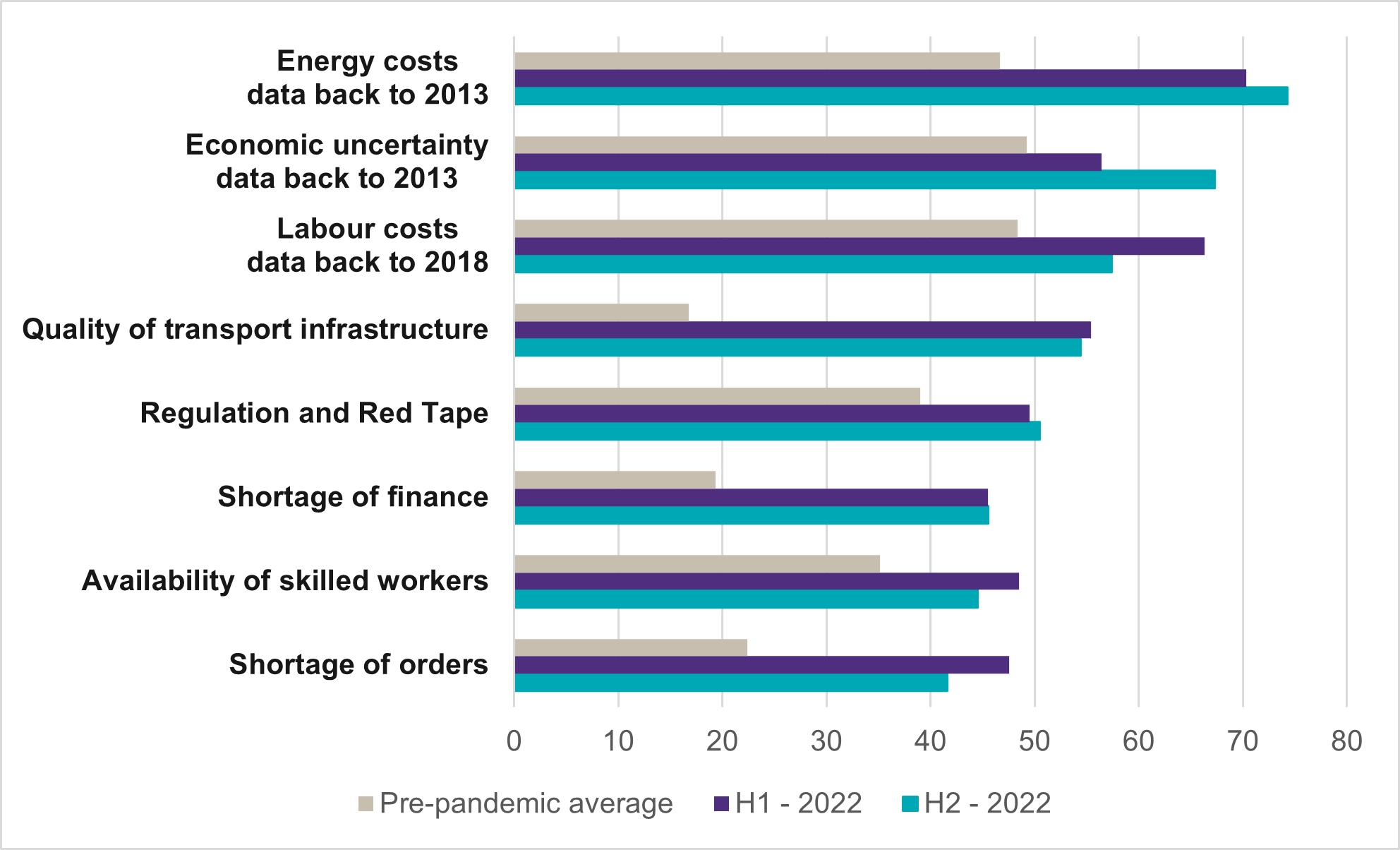

Energy costs (74%) and economic uncertainty (67%) remain the top concerns in South Africa. This is followed closely by labour costs (57%). Economic uncertainty has increased significantly; up 11% from H1 2022. Concerns over a shortage of finance have remained at H1 2022 levels (46%). The true impact of rising interest rates can be seen when comparing historic data as this increased significantly compared to pre-pandemic averages.

Should we be preparing for a short-lived recession?

SA Economy Faces Challenges as mid-market struggle with rising inflation. Economists are predicting a recession amidst the country’s woes in grappling with the energy crisis. Other economies around the world are also preparing for a rather unusual recession that is expected to be a shallow and short one.

Yugen Pillay, Head of ESG and Business Consulting

This means businesses should not respond by imposing long-term measures to address the recession, as the ‘usual’ response to a recession may not be the right course of action for businesses. For example, if the recession is short-lived, layoffs could leave businesses short-staffed when demand picks up again.

62% of mid-market businesses expect the employment rate to increase despite what the data says about economic uncertainty. The reason for this positive sentiment around employment could be that 42% of South African mid-market businesses surveyed, increased their staff levels by more than 5% in the last year. This led to the unemployment rate slightly decreasing to 27.9% in the third quarter of 2022 (from 29.1% in the same quarter in 2021) among workers aged 35 to 44 years. During Covid-19, companies decreased their staff headcounts. So, the increase in staff levels mid-2022 was due to companies capacitating to pre-pandemic levels and the termination of the National State of Disaster.